As the world becomes increasingly aware of the need for environmental sustainability, the financial sector has begun to play a crucial role in promoting eco-friendly solutions. One such solution is sustainable loans, which provide financing options to individuals and businesses looking to invest in projects that benefit the environment. Whether it’s for renewable energy installations, eco-friendly home improvements, or sustainable business practices, sustainable loans are a powerful tool for financing a greener future.

In this article, we’ll explore what sustainable loans are, how they work, the types available, and their advantages. We’ll also address some frequently asked questions and provide valuable insights into how these loans can help create a more sustainable world.

Key Takeaways

- Sustainable loans are specifically designed for financing eco-friendly projects.

- They offer lower interest rates, government incentives, and long-term savings.

- Types of sustainable loans include green mortgages, renewable energy loans, and electric vehicle loans.

- Sustainable loans support both individuals and businesses in their environmental efforts.

- While these loans have many benefits, they may come with higher upfront costs and strict eligibility requirements.

What are Sustainable Loans?

Sustainable loans are financial products that provide funding for projects and initiatives focused on sustainability and environmental responsibility. These loans are designed to support eco-friendly and renewable energy projects, promote energy efficiency, and help businesses and individuals reduce their environmental footprint.

| Aspect | Description |

|---|

| Definition | Sustainable loans are financial products designed to fund environmentally responsible projects. |

| Purpose | To support initiatives that have a positive environmental impact, such as renewable energy, energy-efficient upgrades, and eco-friendly businesses. |

| Types | – Green Mortgages – Renewable Energy Loans – Energy Efficiency Loans – Electric Vehicle Loans – Sustainable Business Loans – Agricultural Sustainability Loans – Green Bonds |

| Loan Terms | Often come with favorable terms such as lower interest rates and longer repayment periods due to the environmental benefits. |

| Eligibility | Borrowers must demonstrate that the loan will be used for projects that promote sustainability and environmental responsibility. |

| Key Benefits | – Lower interest rates – Long-term cost savings – Government incentives (e.g., tax credits) – Positive environmental impact – Increased property value (for eco-friendly homes) |

| Drawbacks | – Limited availability of loans – Higher upfront costs for eco-friendly projects – Strict eligibility criteria – Complex application process |

| Environmental Impact | Projects funded by sustainable loans contribute to reducing carbon emissions, conserving energy, and promoting renewable resources. |

How Do Sustainable Loans Work?

Sustainable loans are structured similarly to traditional loans, but with an added emphasis on environmental impact. Borrowers apply for a loan and receive financing based on the project they wish to fund. The key difference is that the loan’s terms and conditions are influenced by the sustainability of the project.

For example, if an individual or business plans to install solar panels on their property, they may qualify for a sustainable loan that offers lower interest rates and longer repayment periods due to the environmental benefits associated with solar energy. Lenders may also offer incentives, such as tax credits or subsidies, to further encourage eco-friendly projects.

In most cases, sustainable loans are offered by banks, credit unions, and other financial institutions that have established programs focused on environmental sustainability. The borrower must demonstrate that the funds will be used for a project that aligns with sustainability goals. These loans may require proof of the environmental impact, such as energy savings, reduction in carbon emissions, or contributions to renewable energy generation.

Types of Sustainable Loans

1. Green Mortgages

- Overview: Green mortgages are a specialized type of loan designed for financing homes or properties that meet energy-efficient standards. This type of loan helps homeowners or builders invest in energy-efficient construction or improvements.

- Eligible Projects: Green mortgages can finance energy-efficient home construction, solar panel installations, high-performance windows, insulation upgrades, and other energy-saving measures. In some cases, properties that meet certain energy certification standards (such as LEED or Energy Star) may also qualify for green mortgages.

- Benefits:

- Lower interest rates and better terms compared to traditional mortgages.

- Potential tax incentives and rebates for energy-efficient home improvements.

- Long-term savings through reduced energy costs.

- Increased property value due to the eco-friendly features of the home.

- Better indoor air quality and comfort.

- Example: A homeowner uses a green mortgage to purchase a home that has been built with energy-efficient materials and a solar power system.

2. Renewable Energy Loans

- Overview: Renewable energy loans provide funding to individuals, businesses, or organizations to install renewable energy systems such as solar panels, wind turbines, and geothermal heating/cooling systems. These loans are often backed by governments or financial institutions that incentivize the adoption of clean energy solutions.

- Eligible Projects: Solar installations, wind turbines, geothermal heating systems, bioenergy projects, and hydroelectric energy solutions. Renewable energy loans help borrowers transition from fossil fuels to cleaner, renewable energy sources.

- Benefits:

- Lower long-term energy costs by generating clean, renewable energy.

- Reduction in carbon emissions and environmental impact.

- Access to government rebates, tax credits, or subsidies for renewable energy installation.

- Increased energy independence and resilience against rising utility prices.

- Example: A business uses a renewable energy loan to install a wind turbine that powers its operations, cutting down on energy costs and reliance on the grid.

3. Energy Efficiency Loans

- Overview: Energy efficiency loans are designed to help homeowners and businesses upgrade their existing infrastructure to become more energy-efficient. These loans can finance a wide range of energy-saving measures, from appliance upgrades to building retrofits.

- Eligible Projects: Installing energy-efficient appliances, upgrading insulation, replacing windows, improving HVAC systems, lighting upgrades, and energy-efficient roofing. These projects help reduce energy consumption and greenhouse gas emissions.

- Benefits:

- Lower energy consumption, resulting in reduced utility bills.

- Potential government rebates and incentives for energy-saving improvements.

- Enhanced comfort in homes and workplaces due to better insulation and air circulation.

- Improved property value, as energy-efficient homes often command higher market prices.

- Example: A homeowner uses an energy efficiency loan to replace old windows with energy-efficient, double-glazed windows to reduce heating costs during the winter months.

4. Electric Vehicle (EV) Loans

- Overview: Electric Vehicle (EV) loans are designed to help individuals and businesses finance the purchase of electric vehicles or hybrid cars. These loans promote the transition to cleaner transportation options, reducing reliance on fossil fuels and decreasing carbon emissions.

- Eligible Projects: Financing the purchase of electric cars, plug-in hybrid vehicles, electric delivery vans, or electric buses. These loans may also cover the installation of charging stations for EVs.

- Benefits:

- Reduced carbon emissions and air pollution.

- Lower fuel and maintenance costs compared to traditional gasoline-powered vehicles.

- Access to tax credits, rebates, and government incentives for purchasing electric vehicles.

- Enhanced energy independence by reducing reliance on fossil fuels.

- Example: A business purchases an electric van using an EV loan to reduce its transportation-related carbon footprint.

5. Sustainable Business Loans

- Overview: Sustainable business loans are available to companies that wish to invest in environmentally-friendly practices or green technologies. These loans help businesses transition to more sustainable operations, from reducing waste to adopting energy-efficient manufacturing processes.

- Eligible Projects: Green manufacturing practices, energy-efficient equipment, waste management improvements, sustainable packaging, and renewable energy investments.

- Benefits:

- Reduced operational costs due to more efficient processes and reduced waste.

- Increased brand appeal and customer loyalty as consumers increasingly demand sustainable products.

- Lower environmental impact, contributing to corporate social responsibility goals.

- Enhanced market competitiveness by adopting eco-friendly practices early.

- Example: A manufacturer takes out a sustainable business loan to replace outdated machinery with energy-efficient alternatives that reduce electricity consumption and manufacturing waste.

6. Agriculture and Sustainability Loan

- Overview: These loans are aimed at farmers and agricultural businesses who wish to implement sustainable farming practices, improve resource efficiency, and reduce environmental impact. They are tailored to the unique needs of the agriculture industry, focusing on water conservation, soil health, and sustainable crop production.

- Eligible Projects: Organic farming practices, water conservation systems, soil regeneration, sustainable irrigation, and climate-smart agriculture practices.

- Benefits:

- Reduced input costs due to more efficient use of resources.

- Improved long-term sustainability of farming practices.

- Ability to meet the growing demand for organic and sustainably-produced food.

- Contribution to global sustainability efforts by reducing agriculture’s environmental footprint.

- Example: A farm uses an agriculture sustainability loan to implement a drip irrigation system that significantly reduces water waste.

7. Green Bonds

- Overview: Green bonds are a form of debt issued by governments or corporations to fund environmental and climate-related projects. These bonds are considered low-risk investments for individuals or institutional investors who wish to invest in green initiatives.

- Eligible Projects: Large-scale projects like renewable energy plants (solar, wind, hydro), sustainable infrastructure development, waste management systems, and climate change mitigation projects.

- Benefits:

- Provides large-scale funding for high-impact environmental projects.

- Offers attractive returns for environmentally conscious investors.

- Contributes to global efforts to combat climate change and improve environmental sustainability.

- Example: A government issues green bonds to fund the development of a nationwide solar power infrastructure.

8. Water Conservation Loan

- Overview: These loans help individuals, businesses, or municipalities finance projects that aim to conserve water resources. Water conservation is critical in areas experiencing droughts, and these loans help reduce water consumption by funding systems designed to optimize water use.

- Eligible Projects: Installation of water-efficient appliances, rainwater harvesting systems, smart irrigation systems, low-flow faucets and toilets, and drought-resistant landscaping.

- Benefits:

- Reduces water consumption and utility bills.

- Helps conserve a vital natural resource.

- Contributes to better resource management in drought-prone areas.

- Potential cost savings over time by reducing water usage.

- Example: A business installs a rainwater collection system using a water conservation loan to reduce reliance on the municipal water supply.

9. Eco-Friendly Home Improvement Loans

- Overview: These loans are designed for homeowners who want to make their homes more energy-efficient and eco-friendly. From solar panels to sustainable construction materials, eco-friendly home improvement loans allow homeowners to make significant upgrades that enhance the environmental performance of their properties.

- Eligible Projects: Solar panel installations, energy-efficient lighting, insulation upgrades, water-saving technologies, and the use of eco-friendly construction materials.

- Benefits:

- Reduced energy bills due to improved insulation, solar energy, and efficient appliances.

- Increased property value due to energy-efficient upgrades.

- Long-term savings and reduced environmental footprint.

- Example: A homeowner uses an eco-friendly home improvement loan to install solar panels, insulation, and energy-efficient appliances.

10. Climate Adaptation Loans

- Overview: Climate adaptation loans are designed to help businesses, local governments, and communities implement projects that make them more resilient to the impacts of climate change. These loans focus on funding solutions that help mitigate the damage caused by extreme weather events, rising sea levels, or temperature fluctuations.

- Eligible Projects: Flood protection systems, climate-resilient infrastructure, stormwater management systems, seawall construction, and agricultural projects that are designed to withstand climate variability. Climate adaptation loans are essential for adapting existing structures and systems to cope with a changing climate.

- Benefits:

- Enhanced resilience to climate change impacts, reducing future damages.

- Reduced risk to infrastructure and property from extreme weather events.

- Improved public safety and long-term sustainability of communities and businesses.

- Potential for increased insurance savings by mitigating climate-related risks.

- Example: A coastal city takes out a climate adaptation loan to build a seawall and improve drainage systems to protect against rising sea levels and frequent storms.

Advantages of Sustainable Loans

- Environmental Impact

- The primary advantage of sustainable loans is the positive environmental impact they promote. By financing projects that reduce energy consumption, promote renewable energy, and support eco-friendly practices, these loans contribute to the global effort to combat climate change and preserve natural resources.

- Lower Interest Rates

- Many sustainable loans come with lower interest rates compared to traditional loans. Lenders are often incentivized to offer more favorable terms for projects that align with sustainability goals. These lower rates make it more affordable for individuals and businesses to adopt green technologies and make eco-friendly improvements.

- Government Incentives

- Sustainable loans may be eligible for government subsidies, tax credits, or rebates. For example, the installation of solar panels may qualify for federal or state tax credits, reducing the overall cost of the project. These incentives can significantly reduce the financial burden of adopting sustainable solutions.

- Long-Term Savings

- Sustainable loans are often used for projects that lead to long-term savings. For example, energy-efficient home improvements can lower utility bills, while renewable energy systems can generate electricity and reduce reliance on the grid. These cost savings can offset the loan payments over time.

- Increased Property Value

- Eco-friendly homes or businesses often see an increase in property value. Sustainable improvements, such as energy-efficient upgrades or the installation of renewable energy systems, can make properties more attractive to potential buyers or renters. This added value can be a significant benefit for homeowners and business owners.

- Support for Green Businesses

- Sustainable business loans provide financial support to companies that are working to reduce their environmental impact. By supporting businesses that adopt green practices, these loans contribute to the growth of the green economy and help create more job opportunities in the renewable energy and sustainability sectors.

Disadvantages of Sustainable Loans

- Limited Availability

- Sustainable loans are not as widely available as traditional loans, especially in certain regions or markets. Not all financial institutions offer green loans, and those that do may have strict eligibility criteria.

- Higher Upfront Costs

- While sustainable loans can result in long-term savings, the upfront costs of eco-friendly projects can still be high. For example, installing solar panels or purchasing an electric vehicle may require a significant initial investment, which can be a barrier for some individuals or businesses.

- Stringent Eligibility Requirements

- Some sustainable loans have strict eligibility requirements, such as proof that the project meets specific environmental standards or certification. This can make it more difficult for borrowers to qualify, particularly if they are unsure whether their project meets the necessary criteria.

- Complexity of Loan Terms

- Sustainable loans may come with more complex terms and conditions than traditional loans. Borrowers may need to navigate additional paperwork or documentation related to the environmental impact of the project. This can be overwhelming for individuals or businesses that are unfamiliar with green financing options.

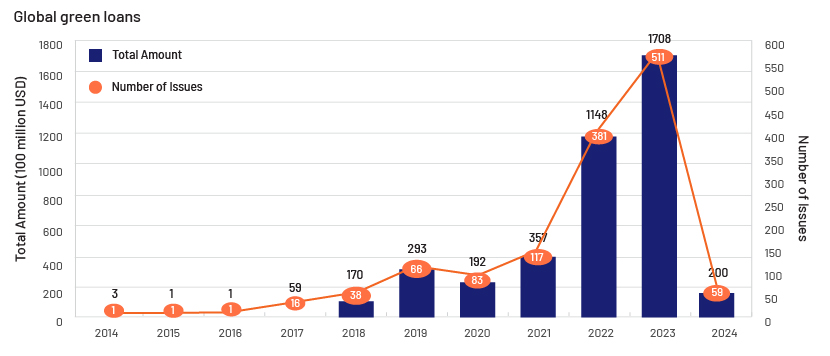

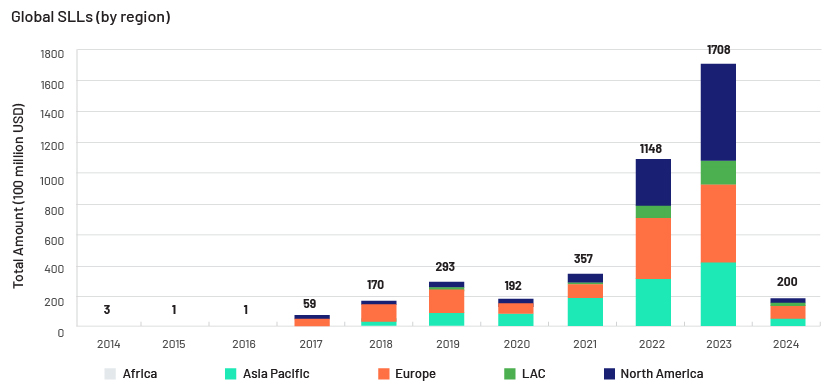

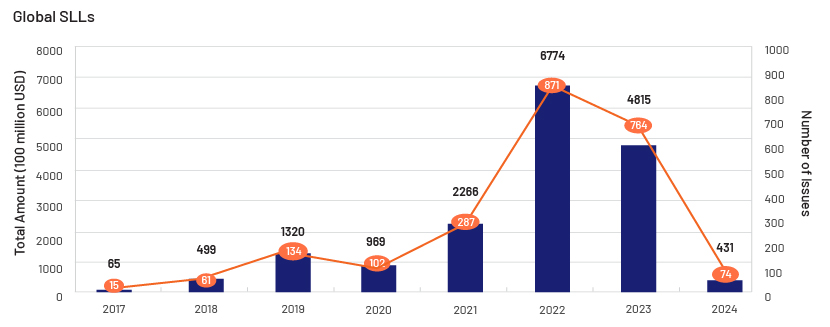

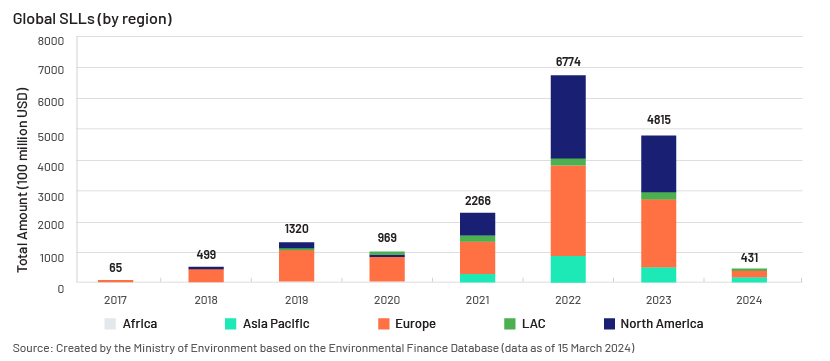

The following charts show growth of green loans and SLLs:

* The value of green loans totals the value of loans labelled as such in the Environmental Finance Database. Environmental Finance does not have its own screening criteria but rather aims to track and include all self-labelled loans.

Source: Created by the Ministry of Environment based on the Environmental Finance Database (data as of 15 March 2024)

Also Read: How Can Green Loans Help Fund Sustainable Projects?

Conclusion

Sustainable loans provide a unique opportunity to finance environmentally responsible projects that can help create a greener, more sustainable future. Whether it’s for a home renovation, renewable energy system, or eco-friendly business practices, sustainable loans offer numerous benefits, including lower interest rates, long-term savings, and government incentives. By investing in these loans, individuals and businesses can contribute to reducing carbon footprints and promoting sustainability.

FAQs

What is the difference between a green loan and a traditional loan?

- A green loan is specifically designed to finance environmentally sustainable projects, such as renewable energy installations or energy-efficient upgrades. Traditional loans, on the other hand, are not focused on environmental impact and can be used for a variety of purposes.

Can I get a green loan for my home renovation?

- Yes, green loans are available for home renovations that improve energy efficiency, such as installing solar panels, upgrading insulation, or replacing windows. These loans may offer better terms than traditional loans due to the environmental benefits.

Are there any government incentives for green loans?

- Yes, many green loans are eligible for government incentives, such as tax credits, rebates, or subsidies. For example, the installation of solar panels may qualify for federal or state tax credits, reducing the overall cost of the project.

Can sustainable loans be used for business purposes?

- Yes, businesses can apply for sustainable loans to finance projects that promote sustainability, such as upgrading to energy-efficient equipment, implementing green manufacturing practices, or investing in renewable energy.

Are sustainable loans more expensive than traditional loans?

- While sustainable loans may have higher upfront costs, they often come with lower interest rates and long-term savings through energy efficiency or other eco-friendly benefits. Over time, these savings can offset the higher initial investment.

How do I apply for a sustainable loan?

- To apply for a sustainable loan, you’ll need to provide details about your project, including how it contributes to sustainability. You may also need to demonstrate energy savings, environmental impact, or compliance with specific green standards. The application process will vary depending on the lender.

Are sustainable loans available for individuals with bad credit?

- Some sustainable loan programs may have more flexible eligibility criteria, making them available to individuals with bad credit. However, the terms may be less favorable, and borrowers may need to demonstrate the potential environmental benefits of their projects.